Freelancing in India has seen a significant rise in recent years, with professionals across various industries opting for the flexibility and opportunities it offers. However, with the freedom of freelancing comes the responsibility of managing taxes. Understanding the tax liabilities and filing procedures can help freelancers in India avoid penalties and make the most of deductions. Here’s a guide to help freelancers navigate the income tax landscape.

1. Understanding Freelance Income

Freelancers in India are considered self-employed or independent contractors. The income they earn from freelance work is treated as “Income from Business or Profession” under the Income Tax Act. This includes payments received for services provided to clients, whether local or international.

2. Tax Slabs for Freelancers

Freelancers are taxed according to the same income tax slabs as salaried individuals. Here are the tax rates for the financial year 2023-24 (AY 2024-25) under the old and new tax regimes:

Old Tax Regime:

- Up to ₹2.5 lakh – No tax

- ₹2.5 lakh to ₹5 lakh – 5%

- ₹5 lakh to ₹10 lakh – 20%

- Above ₹10 lakh – 30%

New Tax Regime:

- Up to ₹2.5 lakh – No tax

- ₹2.5 lakh to ₹5 lakh – 5%

- ₹5 lakh to ₹7.5 lakh – 10%

- ₹7.5 lakh to ₹10 lakh – 15%

- ₹10 lakh to ₹12.5 lakh – 20%

- ₹12.5 lakh to ₹15 lakh – 25%

- Above ₹15 lakh – 30%

Freelancers can choose between the old or new regime based on which provides them with better tax savings.

3. Eligible Deductions for Freelancers

Freelancers are eligible for several deductions, reducing their taxable income. Some of the common deductions include:

- Section 80C: This section allows deductions up to ₹1.5 lakh for investments in instruments like Public Provident Fund (PPF), Employee Provident Fund (EPF), National Savings Certificates (NSC), and life insurance premiums.

- Section 80D: Deductions on health insurance premiums, up to ₹25,000 for self, spouse, and dependent children, and ₹50,000 for senior citizen parents.

- Section 80E: Interest on education loans can be deducted.

- Expenses Related to Freelance Work: Freelancers can also deduct expenses incurred while conducting their freelance business. These expenses can include internet bills, office rent, travel costs, software purchases, and other related expenses.

4. Presumptive Taxation Scheme

Freelancers with gross receipts below ₹50 lakh in a financial year can opt for the Presumptive Taxation Scheme under Section 44ADA. Under this scheme, 50% of the gross receipts are considered as taxable income, while the remaining 50% is assumed to be spent on business-related expenses. This simplifies the tax filing process, as freelancers are not required to maintain detailed records of expenses.

5. Advance Tax Payment

Freelancers whose tax liability exceeds ₹10,000 in a financial year are required to pay Advance Tax. This ensures that tax is paid in installments throughout the year, rather than as a lump sum at the end of the year. Advance tax is paid in four installments:

- 15% by June 15

- 45% by September 15

- 75% by December 15

- 100% by March 15

Failure to pay advance tax can result in penalties and interest under Sections 234B and 234C of the Income Tax Act.

6. Goods and Services Tax (GST) for Freelancers

Freelancers providing services in India are required to register for GST if their turnover exceeds ₹20 lakh in a financial year. For those offering services to clients outside India, these services are considered exports and are generally exempt from GST, provided certain conditions are met (such as receiving payment in convertible foreign exchange).

7. Filing Income Tax Returns

Freelancers must file their Income Tax Returns (ITR) by July 31st each year (unless extended by the government). Freelancers with gross receipts exceeding ₹2.5 lakh must file their returns, even if they do not owe any tax. The ITR forms applicable to freelancers include:

- ITR-3: For individuals and HUFs having income from business or profession.

- ITR-4 (Sugam): For those opting for the Presumptive Taxation Scheme under Section 44ADA.

8. TDS on Freelance Income

Clients may deduct Tax Deducted at Source (TDS) on payments made to freelancers. The usual TDS rate for freelance services is 10% if the annual payment exceeds ₹30,000. Freelancers should ensure that TDS is correctly deducted and reflect the same in their tax returns. They can claim a credit for TDS while filing their ITR, reducing their overall tax liability.

9. Maintain Financial Records

To ensure smooth tax filing, freelancers should maintain proper records of all income and expenses. This can include:

- Invoices for services rendered.

- Receipts for payments made.

- Bank statements showing freelance income.

- Documents for claiming deductions (such as rent receipts, insurance premiums, etc.).

Keeping these documents organized will help avoid any issues during tax audits or assessments.

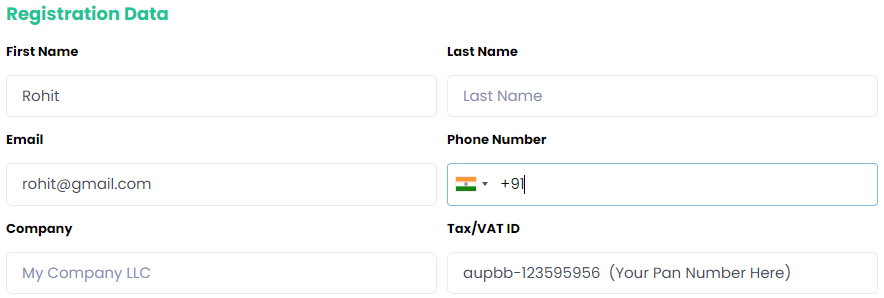

10. How KennFlik deducts tax in India?

KennFlik is not registered in India however due to some recent amendments in the Indian taxation related to Freelancing tax. KennFlik is now required to collect GST from all Indian freelancing service providers and business or individual availing the service at 1% on the amount paid by the buyer and received by seller. Although, it is required to be collected only from persons who are registered in GST. Freelancers and agencies who have not provided a PAN, we will deduct 5% of all your earnings on the platform.

Upon successful registration on KennFlik platform please add your pan card number in (Tax/VAT ID Field) under your account Settings section.

. The TDS will also be set to a lower rate (1%) for now however, Indian users are required to provide PAN by 2021 May 17. If you need assistance configuring your PAN in the Settings page, you can click Contact Us below.

11. Penalties for Non-Compliance

Freelancers should be aware that failing to file tax returns or paying taxes on time can result in penalties. The penalty for late filing can range from ₹1,000 to ₹10,000, depending on the delay. Additionally, interest will accrue on unpaid taxes.

Conclusion

Freelancers in India must take proactive steps to manage their taxes efficiently. By understanding the tax slabs, availing of deductions, and maintaining accurate financial records, freelancers can optimize their tax liabilities and avoid penalties. It is advisable to consult a tax professional or accountant for personalized advice, especially if your freelance business grows in complexity.

By staying informed and compliant, freelancers can focus on growing their business while ensuring they meet their tax obligations in a hassle-free manner.